Share this

How to set up Equity Pick Up in Oracle HFM? Part 1

by Bert Dotinga

Calculating the current value (equity) of all the subsidiaries on the balance can be time consuming and error prone. Equity Pick Up (EPU) in Oracle HFM helps to create an accurate and smooth flow, enabling you to easily include the correct value of each subsidiary. How does Equity Pick Up work in HFM?

Most organizations put the value of their subsidiaries for the purchased (fixed) amount on their balance. Some countries, like the Netherlands, must use the current value (equity) of their subsidiary on the holding’s balance. Equity Pick Up (EPU) in HFM facilitates this. It lets you re-evaluate your subsidiary’s equity and puts the current value on the holding’s balance, based on the holding’s share in the subsidiary.

Letting HFM calculate the EPU values provides the following benefits:

- No differences between equity of the subsidiary and holding, and therefore no consolidation differences.

- Participation values and result of the subsidiaries are up to date; the holding does not have to wait for the subsidiary’s definitive figures.

- If EPU entries have to be posted in the General Ledger, the EPU figures in HFM provide a lot of insight.

How to set up Equity Pick Up (EPU) in Oracle HFM?

Setting up the EPU in Oracle HFM consists of three steps;

- a data entry form for input of the shares,

- a separate EPU member in the metadata as data source

- and the EPU rules.

Step 1. Set up the data entry form to include the shares

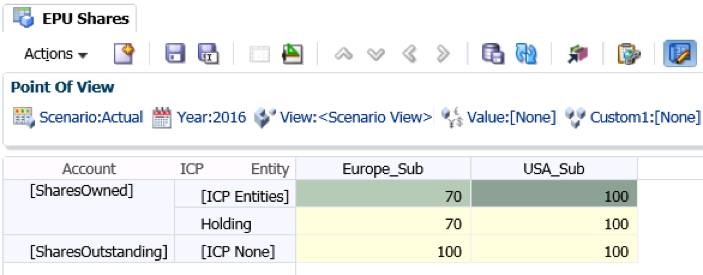

For setting up the form we use the system accounts [SharesOwned] and [Shares Outstanding] in conjunction with the Holding (Owner) and Subsidiary (Owned). In the screenshot below we have one owner ‘Holding’ and two subsidiaries named ‘Europe_Sub’ and ‘USA_Sub’. Holding owns 70 out of 100 shares of ‘Europe_Sub’ and all shares (100) of ‘USA_Sub’.

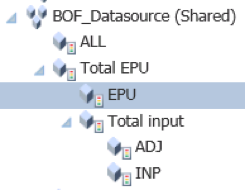

Step 2. Create an EPU member in the metadata

In the metadata we create an EPU member as ‘data source’, on which the EPU rule will store the result of the EPU calculations. With this set up, analyzing the result of the EPU calculation will be easier.

Step 3. Set up the EPU rules

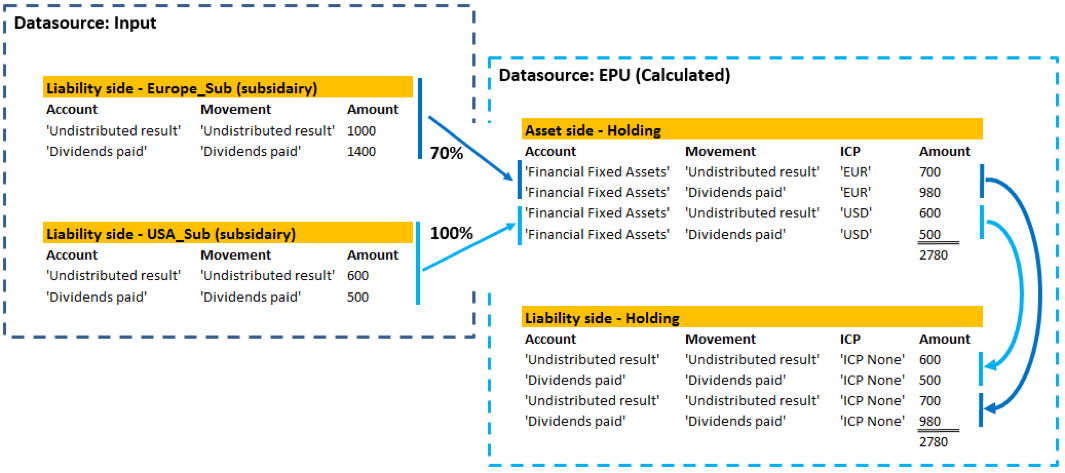

The objective of the EPU rules is to create the correct data entry on the asset- and liability side of the holding’s balance. The EPU function in the rules (called PEPU; Percentage Equity Pick Up) executes the calculation for each pair of the Holding-Subsidiary relationship. In our example there are two Holding- Subsidiary relationships;

- Holding > Europe_Sub (70%)

- Holding > USA_Sub (100%)

On the asset side of the Holding’s balance we need to populate the account ‘Financial Fixed Assets’. On the liability side we will populate the appropriate equity account.

The data of the subsidiary is entered per combination equity account/movement. By running the EPU calculation it is moved to the Asset side of the holding with the same movement and the ICP of the subsidiary. From the Asset side of the holding, based on the movement, the appropriate equity amount is populated on the liability side of the Holding’s balance. The EPU closing balance is calculated as the total of the movements and opening balance.

The example above shows the basics for the EPU calculation. Of course variations and extensions can be made based on your financial needs.

A smooth flow

Set up like this, Equity Pick Up in Oracle HFM is a great way to turn this complex process into a smooth flow. It helps you to calculate the current value of your subsidiaries, easily and without errors, preventing consolidation errors.

How does Equity Pick Up work in Oracle HFM? Part 2

In this blog we explained how to set up EPU within HFM. In our next blog, the second part of ‘How does EPU work in Oracle HFM?’, we will tell you how to run and use EPU in HFM.

Do you want to get the most out of your Oracle HFM application? Discover the benefits of our support for Oracle EPM/ Hyperion and the options of our EPM Support Services.

Text: Bert Dotinga

Share this

- December 2025 (1)

- November 2025 (2)

- April 2025 (2)

- March 2025 (2)

- February 2025 (2)

- December 2024 (1)

- July 2024 (3)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (3)

- December 2023 (1)

- June 2023 (1)

- April 2023 (1)

- March 2023 (1)

- December 2022 (1)

- September 2022 (1)

- August 2022 (2)

- February 2022 (1)

- December 2021 (1)

- May 2021 (15)

- April 2021 (24)