Share this

Predictive Analytics in Finance: Uncertainty is the new normal

No matter what: elections, international conflicts, trade wars, or a global pandemic, worldwide organizations are affected by external events that are not controlled by them and can have a huge repercussion on their performance. How can you use Predictive Analytics to react timely and correctly to these events?

As a financial, you are used to navigating through uncertainty. Your finance teams have the remarkable opportunity to add value to your organization by delivering timely and insightful financial data to support decision-making in today´s fast-paced environment. A good prediction, even for black-swan events such as COVID-19 or the Ukrainian crisis, enables companies to act fast. Connecting different business areas in a long-time plan helps to exchange ideas internally about risks and opportunities. This is why long-range planning and rolling forecasts are so vital.

Nowadays, Finance teams are the strategic partner of the CEO, developing and sharing insights with other departments such as sales, supply chain, or marketing to help them make more informed decisions.

Use of Predictive Planning

Historically, the traditional planning process in companies was a long budget cycle. Budget owners (generally, managers at cost center level) provided input on their expectations for next year and submitted it for approval. These budgets were added up, and the company´s management team would review and modify them, sending the corrections top-down to the budget owners to adapt their numbers to the new goals.

Modern planning is different. It aims to help companies focus on the global strategy by aligning it with the various business units. This allows companies to focus more on long-term planning by clarifying the goals to achieve and the drivers for such growth. Then, those objectives are translated into actions that will end up in assumptions for the three financial statements.

Predictive planning is key for connecting global strategy and financial goals. It helps you by:

- Assisting in target setting to support strategic planning.

- Creating baseline forecast scenarios from comparison with internal bottom-up forecasts.

- Automatic generation of new forecasts based on predictive models.

Predictive Analytics in OneStream Software

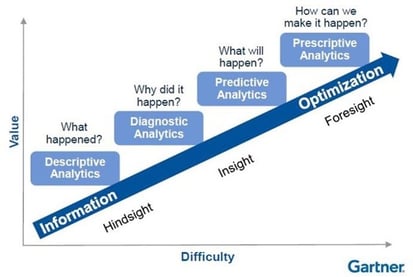

Gartner sees Predictive Analytics as a phase in the evolution of analytics that follows the descriptive and diagnostic phases. These phases involve zooming into the past to determine what happened, where and by whom and then answering the question of why certain things happened. With Predictive Analytics, we take the next step towards using the data to predict the future. This gives executives the ability to base decisions on facts, rather than gut feelings and intuition. According to Gartner, only 13 percent of companies currently base their strategic decisions on Predictive Analytics.

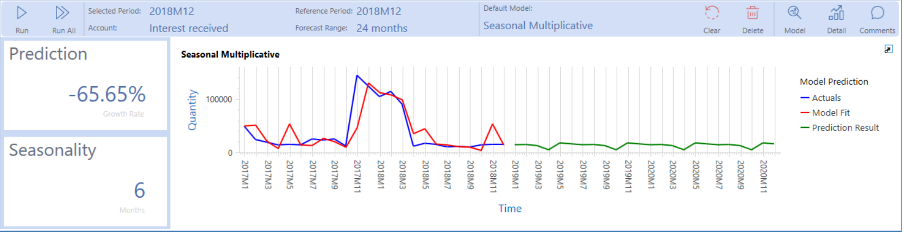

Currently, there are several exciting tools on the market that enable you to achieve predictive planning, for example, by OneStream. OneStream Predictive Analytics 123 is available in the XF Marketplace and provides a forecast baseline based on historical data patterns.

How does OneStream Predictive Analytics 123 work?

The solution cycles through multiple forecast methods based on Seasonality and Trend to determine the most accurate forecast. It creates and presents models to support forecasting, prediction, and what-if analysis to determine the most appropriate forecast scenario.

OneStream automatically selects the best predictive model for your data based on the historical data provided. This historical range is set to 18 - 48 months, depending on the type of prediction. You can apply the selection of the model for the most common forecasting methods, such as:

- Simple Exponential Smoothing

- Holt Linear (and Holt Linear Multiplicative)

- Holt-Winters Exponential

- Seasonal Additive

- Holt-Winters Exponential Multiplicative

- Holt-Winters Damped Method

- Autoregressive Integrated Moving Average (ARIMA) (and Seasonal – SARIMA)

Pros and cons of using OneStream Predictive Analytics 123

Often, we see that financials are still using a historical data reporting approach, where they analyze available data to reflect on past performance instead of using it to predict the future. Typically, decisions based on this data are intuitively and rarely data-driven.

Predictive analytics can help finance departments and CFOs to:

- Assist with the target setting to support strategic planning, budgeting, and rolling forecasts.

- Create baseline predictive forecast scenarios for comparison against bottom-up forecasts from operational business partners

- Seed forecast and plans with predictive models; enable users to finetune plans such as adding or removing customers, plant shutdowns, or new acquisitions.

Pros of using OneStream Predictive 123

- No statistical knowledge is required to model your data.

- OneStream will automatically select the best predictive model for the provided data by account.

- Intuitive configuration for users to play around and practice.

Cons:

- Predictive analytics is NOT machine learning. Traditional predictive analytics models cannot provide the same business insight that ML can.

- The world around us keeps changing. So even though OneStream will automatically select the best predictive model for the provided data, you still have to validate the data and the drivers continuously.

Predictive Analytics in practice

I’d like to share with you one of our cases using Predictive Analytics to predict buying behavior. This behavior is one of the most common ways in the retail industry to identify habits based on previous purchase history.

A retail organization wanted to forecast the sales per region for different products using their historical sales data. The prediction based on actuals was used as a baseline to create the strategic sales objectives. These were shared with the sales departments to set the sales objectives for the following year.

Automatic, high-quality predictions

Having this prediction made automatically by the system avoided human interpretations and applied seasonality and buying cycles that “standard” forecasts could not detect.

Implementing Predictive Analytics 123 increased the speed and flexibility of the forecasting and budgeting processes. Also, it allows the finance teams to invest more time analyzing data rather than calculating the forecast prediction themselves.

Share this

- December 2025 (1)

- November 2025 (2)

- April 2025 (2)

- March 2025 (2)

- February 2025 (2)

- December 2024 (1)

- July 2024 (3)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (3)

- December 2023 (1)

- June 2023 (1)

- April 2023 (1)

- March 2023 (1)

- December 2022 (1)

- September 2022 (1)

- August 2022 (2)

- February 2022 (1)

- December 2021 (1)

- May 2021 (15)

- April 2021 (24)